Nowadays, the supply chain is scattered in a series of different tiers and business is disintegrated with third party suppliers along the various steps of the product chain. While this has boosted the efficiency and cost effectiveness of the industry, people began to lose control of their assets.

The Aberdeen Group defined Supply Chain Visibility as “the awareness of, and control over, specific information rated to product orders and physical shipments, including transport and logistic activates and the status of events and milestones that occur prior to and in-transit”.

According to PwC Chile, an optimal visibility diminishes the risks of failures in the supply chain, improves the level of service, optimizes operation process and improves the levels and quality of inventory. Therefore, the industry needs insightful visibility in products, suppliers, operations, and clients.

More importantly, it helps an organization transitioning from reactive logistics to a proactive logistics. Hence, it has a direct impact on a business' competitive advantage.

An extended visibility is an increasing need. However, its practice is still limited in several ways.

An Aberdeen Group study shows that the top pressures for improving supply chain visibility are:

- 43%: the need to improve supply chain operational speed and/or accuracy.

- 30%: increased stakeholder and customer demand for accuracy and timeliness of inbound and outbound shipment events.

- 26%: the business mandate to reduce supply chain execution costs.

- 15%: the need to reduce, proactively allocate or manage inventory held at various stages in the supply chain.

- 13%: the need to optimize the numbers of trading partners, suppliers, carriers, logistics service providers (LSPs).

According to the study, the top strategic actions is the improvement of internal cross-departmental visibility and integration into supply chain transactions and costs, as well as streamlining processes for easier fleet monitoring, enhance usability or efficiency.

In fact, the best logistics companies have integrated visibility. The 20% top performing companies in the study are:

- 61% more likely than all others to gain visibility into international outbound shipment status within hours

- 57% more likely than all others to gain viability into international inbound shipment status within hours.

The Gatepoint Research developed a Trends in Supply Chain Visibility Survey, asking top supply chain executives about their habits in the use of visibility. The results are discouraging.

- There is a limited supply chain visibility: 41% of respondents reported that their supply chain visibility extended only as far as Tier 1 relationships with contract manufacturers.

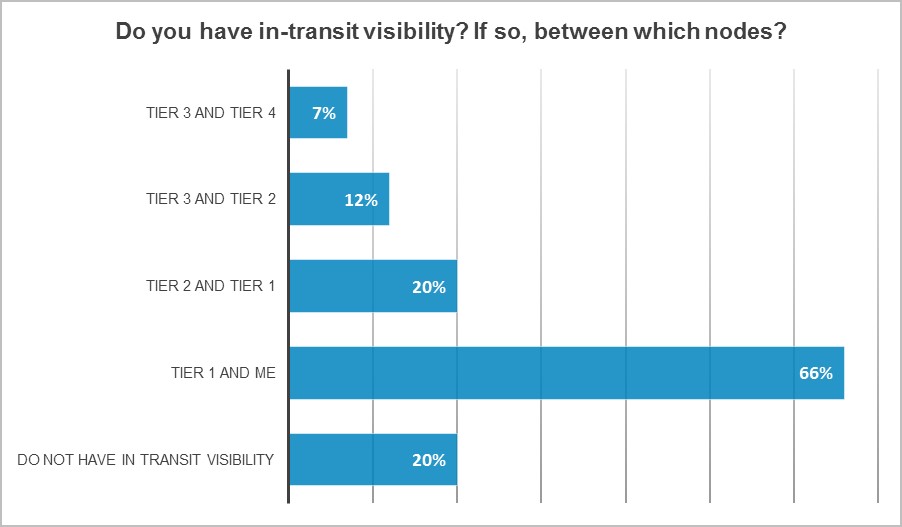

- There is an important lack of ability to trail goods in transit: 29% have visibility between themselves and Tier 1, but only 7% can see between Tiers 4 and 3.

- Decisions are still based on old data instead of real-time data: even tough timeliness is essential only 14% of the people surveyed have access to data in real time.

- Key decision makers fail to use it: 79% of responders teams have access to data, and 71% use it. Despite that 31% of chief supply chain officers have access to visible tools, only 16% use it.

- Only 19% respondents report end-to-end visibility.

However, the study sheds some lights on the use of visibility information. 78% of respondents use these data to ensure continuity of supply and 70% use it to get an early warning of supply chain problems or disruptions.

However, an agile response to supply and demand is not an issue for half of the respondents, and only one out of four companies monitor partner compliance with commitments.

A responsive answer to unexpected changes is increasingly important, due to the dynamic variations in the market today. Partner compliance monitoring is also critical, as they also influence a logistics operation bottom line.

Then again, these studies shed sensitive data on visibility, but also on what we need to improve in the logistics and supply chain industry. Even though proactive alerts are important to keep up not only with a quality of service but competitive challenges, this is highly underdeveloped. Real-time responsiveness is developing, but it's not yet a trend. Worse, systemic integration is hardly a trend, but an exception.

What do you think about these trends? How is your supply chain visibility integrated into your business? I would like to hear your comments and suggestions.

.jpg)

.jpg)