Is the extension of the Panama Canal sufficient for the country? According to expert institutions such as the World Bank, the country needs to improve, for instance, fleet tracking systems.

On July 26th, the Panama Canal expansion was officially opened, and its new locks received the first natural gas ships. According to the T21 portal, the Panama Canal Authority (ACP), the capacity of this center will allow between 10 and 12 ships of the New Panamax size, with a length of over 400 meters and a cargo capacity of over 1,300 TEUs.

This will allow for approximately 40 passes through the canal a day, increasing three times their management capabilities, reducing waiting times and increasing income for up to 4 billion dollars a year by 2020.

It is worth noting that logistics operators should monitor what goes on in Panama and how it will impact the transport system of the country and the region.

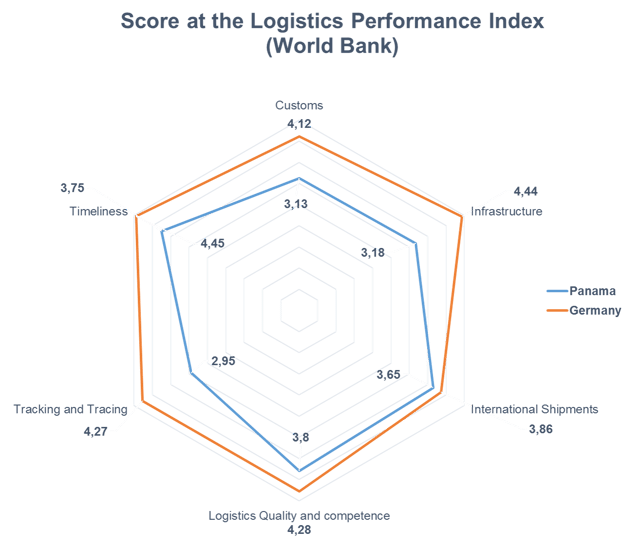

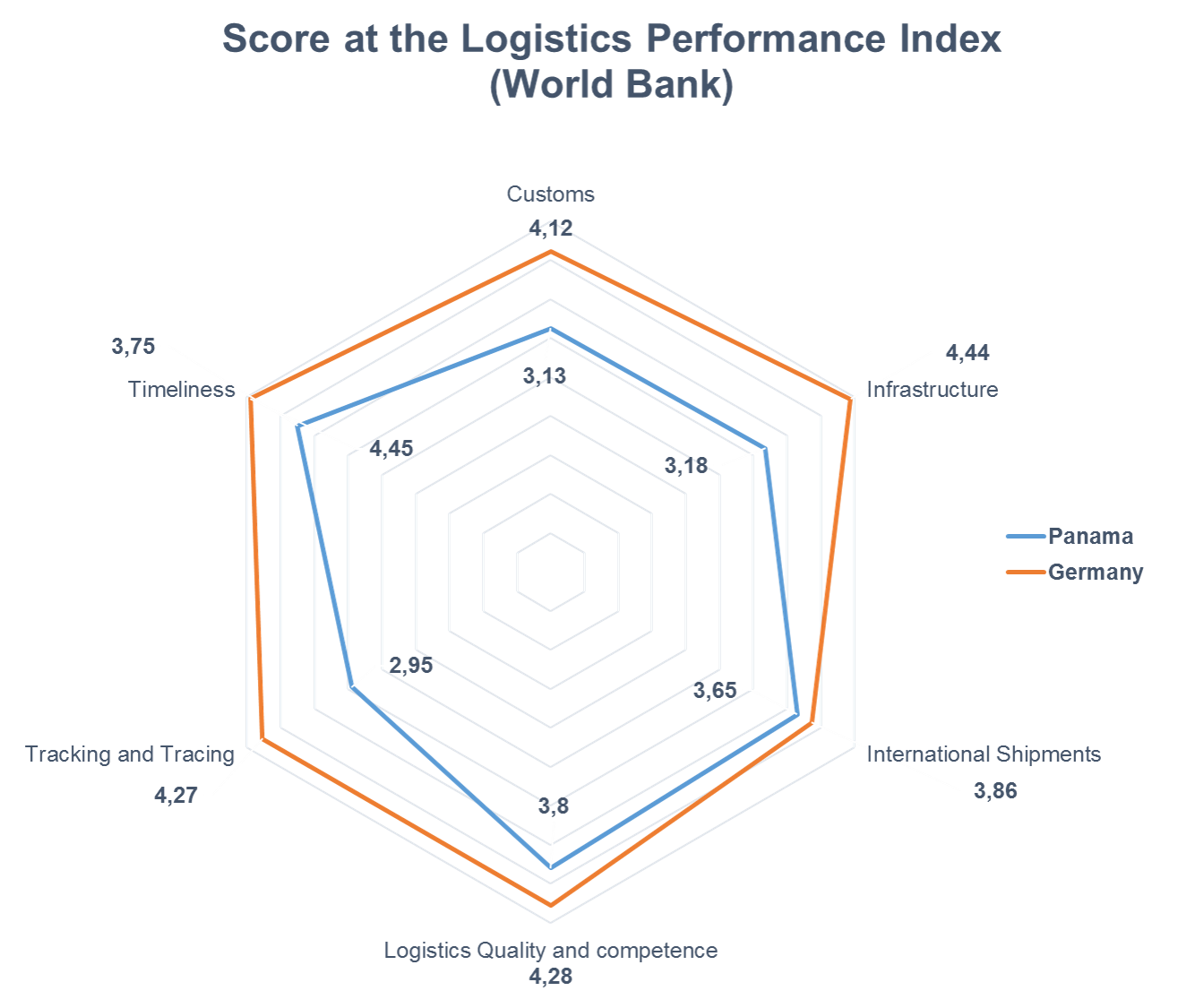

According to the World Bank, Panama advanced five positions at the Logistics Performance Index (LPI), which analyzes countries in six components:

- The efficiency of customs and border management clearance

- The quality of trade and transport infrastructure

- The ease of arranging competitively priced shipments

- The competence and quality of logistics services

- The ability to track and trace consignments

- The frequency with which shipments reach consignees within scheduled or expected delivery

Panama has displaced other transportation powers in the region such as Brazil, Chile, México, and Colombia, from 61th to the 45th place.

The World Bank Director for Central America, Humberto Lopez, told El Economista that “a few differences” on the index can generate significant changes in the country positioning on the ranking.

Why optimize transport logistics in Panama

The Spanish version of the World Bank Study was presented as part of a conference about Latin American logistics as an engine for growth in Panama, organized by the Americas Society/Council of the Americas.

However, the study also implies the need to improve supply chain management with proper tracking systems.

According to the World Bank study, the ability to track and trace consignments is the worst area evaluated. Even though Panama is number 45 worldwide, regarding tracking it is number 63, with 2.95 points. Countries with the best evaluations, such as Germany, for instance, reach 4.25 points in this area.

That is why de Development Bank of Latin America (CAF) is working on a World Class Connectivity and Logistics strategy for the country, in order to:

- Improve competitiveness in infrastructure and logistical services.

- Extend services to new areas of the canal hub and other regions of the country,

- Diversify and innovate in added value services.

- Improve urban and road transportation for the internal and international network.

According to the president of the Bank, Enrique Garcia: “Panama has significant challenges positioning its value added services”.

Infrastructure and customs policies depend on governments. However, performance indicators (KPI) such as timeliness and tracking depend on internal management within companies and significantly influence international customer confidence, a competitive advantage factor for any logistics operation.

Any improvement in tracking and tracing will improve value added services for the supply chain system of the country.

What do you think about the recent developments of Panama? What elements can help optimize tracking and improve the competitive advantage of supply chain management in this country?

.jpg)

.jpg)